The goal of ufRisk is to enable the user to compute

one-step ahead forecasts of Value at Risk (VaR) and Expected Shortfall

(ES) by means of various parametric and semiparametric GARCH-type

models. For the latter the estimation of the nonparametric scale

function is carried out by means of a data-driven smoothing approach.

Currently the GARCH, the exponential GARCH (EGARCH), the Log-GARCH, the

asymmetric power ARCH (APARCH), the FIGARCH and FI-Log-GARCH can be

employed within the scope of ufRisk. Model quality, in

terms of forecasting VaR and ES, can be assessed by means of various

backtesting methods.

You can install the released version of ufRisk from CRAN with:

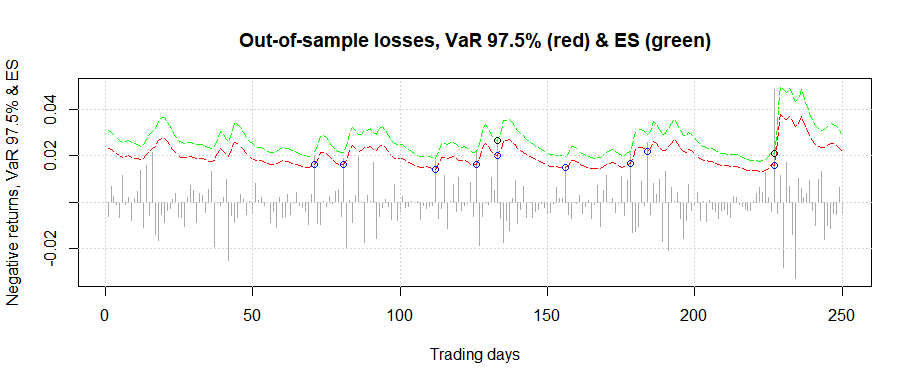

install.packages("ufRisk")The data set ESTX, which is implemented in the

ufRisk package, contains daily financial data of the EURO

STOXX 50 (ESTX) index from April 2007 to December 2021. In the following

an example of the (out-of-sample) one-step forecasts of the 97.5-VaR (red line) and the corresponding ES (green

line) as well as the 99

-VaR (green line), which are obtained by employing

a FIGARCH model to the

ESTX return series, are illustrated.

Exceedances are indicated by the colored circles.

# Applying the FIGARCH model to the ESTX return series

x = ESTX$price.close

results = varcast(x, model = 'fiGARCH', a.v = 0.99, a.e = 0.975, n.out = 250)Visualize your results by means of the implemented plot method

Plotting the out-of-sample loss series:

plot(results, plot.option = 1)

Plotting the out-of-sample loss series, VaR.v & breaches:

plot(results, plot.option = 2)

Plotting the out-of-sample loss series, VaR.e, ES & breaches:

plot(results, plot.option = 3)

Assess the quality of your model by employing various backtesting

methods by means of the functions trafftest,

covtest and lossfunc.

Conduct a traffic light test for VaR and ES

trafftest(results)

#>

#> ###################################

#> # Backtesting results #

#> ###################################

#>

#> # Traffic light zone boundaries #

#> Zone Probability

#> Green zone: p < 95%

#> Yellow zone: 95% <= p < 99.99%

#> Red zone: p >= 99.99%

#>

#> # Test 1: 99%-VaR #

#> Number of violations: 4

#> p = 0.8922: Green zone

#>

#> # Test 2: 97.5%-VaR #

#> Number of violations: 9

#> p = 0.9005: Green zone

#>

#> # Test 3: 97.5%-ES #

#> Number of weighted violations: 5.1227

#> p = 0.9188: Green zone

#>

#> # Weighted Absolute Deviation #

#> WAD = 1.6793Conduct a conditional and unconditional coverage test as well as an independence test

covtest(results, conflvl = 0.95)

#>

#> ##################################

#> # Test results #

#> ##################################

#>

#> # Unconditional coverage test #

#>

#> H0: w = 0.99

#> p_[uc] = 0.3805

#> Decision: Fail to reject H0

#>

#> # Independence test #

#>

#> H0: w_[00] = w_[10]

#> p_[ind] = 0.6865

#> Decision: Fail to reject H0

#>

#> # Conditional coverage test #

#>

#> H0: w_[00] = w_[10] = 0.99

#> p_[cc] = 0.6275

#> Decision: Fail to reject H0

#> Calculate different loss functions

lossfunc(results)

#> Please note that the following results are multiplied with 10000.

#>

#> $lossfunc1

#> [1] 7.693316

#>

#> $lossfunc2

#> [1] 14.31244

#>

#> $lossfunc3

#> [1] 14.56085

#>

#> $lossfunc4

#> [1] 13.61529In ufRisk four functions are available.

Original functions since version 1.0.0:

covtest: Coverage testslossfunc: Calculation of loss functionstrafftest: Traffic light tests for VaR and ESvarcast: One-step ahead forecasting of VaR and ESFor further information on each of the functions, we refer the user to the manual or the package documentation.

ESTX: Daily financial time series data of the EURO

STOXX 50 Index (ESTX) from April 2007 to December 2021WMT: Daily financial time series data of Walmart

Inc. (WMT) from January 2000 to December 2021